Like many people, I have somewhat tuned out to the Affordable Care Act. I tuned out because what I heard on the news always seemed to involve the political aspects of the new law when what I wanted to know was “how does this impact me”.

I had a chance to participate in an conference call with Patrick Blair and Ellie Kay of WellPoint to discuss some of the details of Affordable Care Act. While they couldn’t tell me what the premiums would be because that information won’t be released until October first, they did provide me with an overview of this new program, provided insight into how it could impact my family, and shared important dates that we need to know about.

I was surprised to learn that the program will include 4 different “tiers” of coverage. I was also surprised by the amount of assistance that will be provided to individuals and families to help them purchase coverage. I am sharing what I learned in this article.

On October 1 open enrollment will begin under the Affordable Care Act. This will mark the beginning of health care reform, which was passed in Washington a couple of years ago. It is officially called the Affordable Care Act (ACA), however most people know it as ObamaCare. It is the beginning of a complete change in the way we purchase health care coverage and access care.

The system is intended to allow everyone the ability to buy health insurance regardless of whether they have a pre-existing condition, and women are charged no more than men; a system where –

- If you do not get insurance through your work – for example you are self-employed – you can get insurance through an online marketplace, or exchange.

- If you need and qualify for help paying for coverage on the exchange, you can get help with government subsidies.

- If government subsidies don’t offer the assistance you need, you can get coverage through Medicaid.

Certain benefits must be included in the new health plans. Things like emergency services, maternity and newborn care, pediatric services, mental health and substance use disorder services, preventive and wellness services and chronic disease management. These are called “essential benefits.”

Lawmakers created an “incentive” for people to buy health insurance with a tax penalty for those who do not. The penalty tax is 1 percent of your annual income, or $95 per individual, $285 per family, depending on which is greater.

With Medicaid though, it gets a bit complicated, because many states voted not to expand Medicaid. There are several exemptions from the penalty, such as those who have incomes so low that they are not required to file tax returns, no access to affordable coverage, or “other hardship exemptions.” See where your state stands on Medicaid expansion.

What this means for us:

Open enrollment is extra-long this year, running from the beginning of October to the end of March, so that people have lots of time to ask questions and weigh their options. But, if you want coverage to start on January 1, you need to have signed up for a plan by December 15. And if, down the road, you experience a life change that requires you to re-evaluate your insurance, you will have the opportunity to adjust things.

If you are buying an individual plan on the exchange, it will be a little like comparison shopping on Amazon or booking a trip through Expedia or Travelocity.

Plans will come in levels or tiers

There will be four levels or metallic tiers, depending on how much you want to spend. The general rule is that your deductible will be lower, the more you spend on your monthly premium. So for example, at the Platinum tier, 90% of your expected cost will be covered, but you will pay higher monthly premiums. A gold plan will cover 80% of your costs. A silver plan will cover 70% and a bronze plan will cover 60%.

- Levels are based on the percentage the plan pays of the average overall cost of health benefits

- Each level may have a few plans to choose from

- Bronze plans have the lowest monthly premium, but will cover 60% of expected costs

- Platinum plans have the highest monthly premium, but will cover 90% of expected costs

At each level, there will be a few health plan options to choose from. And you will be able to choose your own in-network primary care physician, OB-GYN and pediatrician without a referral. Co-pays and deductibles will vary depending on the plan you select.

Another important element is that the ACA requires that dependent coverage be provided for children until they turn 26 years old. So children are eligible to receive coverage regardless if they are in college, a tax dependent or are married.

Some health plans that were in force by March 23, 2010, are eligible to be grandfathered forward. These would be plans that meet many requirements of the new healthcare reform. However, if a small employer group – for example – does not have a grandfathered plan, then they would have to offer the metallic tiers within their benefit plan.

Your yearly income will determine whether you qualify for financial help. For example, assistance will be available for individuals who make $45,000 a year and a family of four that makes about $92,000 a year. Assistance will be offered on a sliding scale, meaning that the less money you make, the more assistance you’ll get.

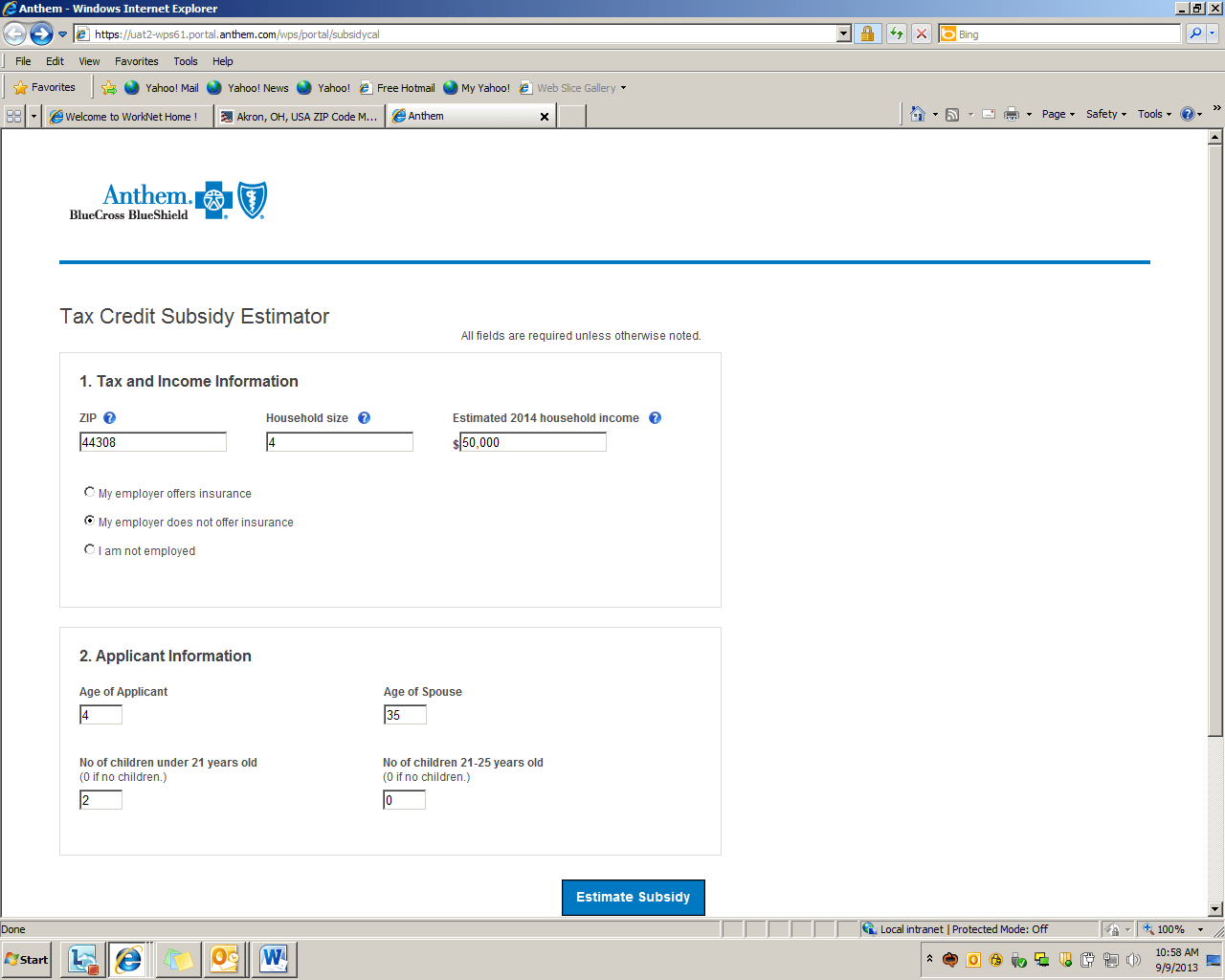

For those looking at Anthem and its sister plans, there will be checklists to make sure that you’ve done all you need to and a tool to help you estimate the kind of subsidy you may qualify for.

As far as rates go, more details will be announced on October 1. Because the law guarantees coverage, adds essential health benefits and eliminates pre-existing conditions restrictions, some people, particularly those who have paid lower premiums in the past, may find costs will go up. It’s also important to know that health insurers have to submit rates that federal and state regulators approve. If an insurer spends less than 80 cents of a member’s premium dollar on their medical care, they are required by law to issue that member a rebate.

Here are some websites you can visit to learn more:

Where to go to find healthcare plans by state?

- Healthcarereformforyou.com

- Healthcare.gov

- The Kaiser Family Foundation at Kff.org

I encourage you to start researching health care plans as soon as possible, so you can make an informed decision and avoid penalties.

Dislosure: This is a sponsored post on behalf of The Motherhood and WellPoint.

Cyndy says

I can tell you how this law is affecting my family. Our rates have increased and our potential out of pocket costs have increased substantially! I support health care reform but this law is making a bigger mess of a big mess.

jake says

Cyndy, I think you need to go to the exchange and do comparisons. My policy was one that was cancelled and the one provided by the company to replace it would have cost me more.

However, I went to the ACA exchange and obtained a better policy for substantially less money. People need to do their homework and shop the exchange. If the website is a problem, get on the phone. There are very helpful people that that will help you. That’s what I did!