Have you resolved to get out of debt? Dave Ramesy’s Baby Steps will give you a doable plan to pay off debt and start building a savings.

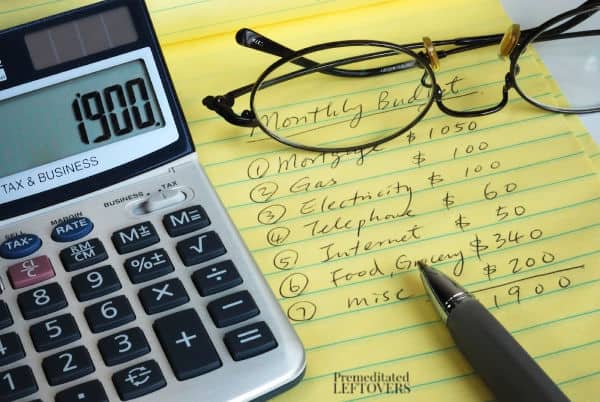

The Total Money Makeover system is set up to help people get their finances back on track. It works by helping you to get on a budget and then walking you through Dave’s 7 Baby Steps to help you save for emergencies, get out of debt, and build wealth. Here is why you should use the Dave Ramsey Method.

How to Get Out of Debt Using Dave Ramsey’s Baby Steps

Have you heard about the famous Dave Ramsey and his methods for getting out of debt, yet you aren’t sure how to get started? His baby steps can be a powerful journey for many families to get rid of debt and build wealth for the future. Read on to find out more information as well as tips to getting through the baby steps in order to bust through your debt!

Soak in the Baby Steps Information

Learn all you can about Dave Ramsey’s debt relief methods before you start. It’s helpful to read testimonials, scour Dave’s own website for information and tips, and ask around to any family members or friends who have followed the steps. Having the knowledge going in will make the entire process easier.

Helpful Books from Dave Ramsey

Total Money Makeover Companion Workbook

Dave Ramsey’s Complete Guide to Money

Tips for Baby Step 1: $1000 Emergency Fund

The most important factor of Baby Step 1 is to save the $1000 as fast as you can. Get a second job, sell things on eBay, have a yard sale…whatever will get you the money ASAP. The reason for speed is so that you don’t lose sight of your financial goals or get discouraged before you get to the more difficult steps.

Make sure you keep the emergency fund separate from your regular checking account. Open a savings account, have a trusted family member hold onto the money, or keep it in a safe at home. Wherever it sits, know that it should ONLY be used for unexpected emergencies.

Tips for Baby Step 2: Use the Debt Snowball Method

List the debts by balance, starting with the smallest. This is the debt you will tackle first while continuing to make minimum payments on all others.

Using the “Debt Snowball” method helps keep you motivated to move forward and continue knocking out debts until you have everything paid off.

Tips for Baby Step 3: Save 3-6 Months of Expenses for Emergencies

Once you have no debt except for your home mortgage, you will find it easy to save enough money to cover 3-6 months of expenses. This will help safeguard your family from any major illness, job loss, or other unexpected events.

This money should also stay separate from your regular checking account and stowed away in case you miss work for any reason.

Tips for Baby Step 4: Roth IRAs and Pre-Tax Retirement Funds

Once your debt is knocked out and you have plenty in savings, it’s time to think about investing in your retirement. Begin by investing in your company’s 401(k) to get the most benefit from your employer’s match. Invest the rest of the 15% of your household income into Roth IRAs – being sure to spread them out into the various types of mutual funds.

Tips for Baby Step 5: College Funds for Kids

Do your homework when it comes to investing in your children’s education future. Your two most beneficial methods for completing this step is 529 college savings plans or ESAs (Education Savings Accounts). Make sure you choose wisely so you don’t waste money!

Tips for Baby Step 6: Pay Off Your Home

With debt gone and investments set, it’s time to get that house payment eliminated! Put any extra cash you can toward your mortgage until it’s paid in full. You may want to consider refinancing as you get into this step, to save even more money.

Tips for Baby Step 7: Build Wealth and Give

It’s now time to decide how you want to spend your money! With no debt in the way and your investments lined up to protect your future, you can start thinking about donations and inheritances – anything that helps you give back to the world. As always, you want to give wisely.

Hopefully, these tips for getting out of debt with Dave Ramsey’s Baby Steps will help those looking to get started with his methods. It’s a long road – it could take you 2-4 years of “gazelle intensity” in order to complete all steps, but the most important thing is you STAY FOCUSED so you can live the life you want and have the future you and your family deserve!

More Budgeting Tips

5 Ways to Start Building Your Emergency Fund Faster

How to Stop Using Credit Cards

Tips for Getting Debt Under Control

Leave a Reply