As you begin working on paying off debt, you’ll find our Budget Planner and Bill Reminder Printable a great tool that helps you stay on track. I am always a huge fan of making sure that I have multiple methods of staying on track when it comes to paying bills. Being able to stay on track means you don’t have late bills or service charges for not being on time. These printables are ideal to help.

How to Use a Budget Planner and Bill Reminder

You can find the printable budget planner and bill reminder here.

As you begin working on your budget, you’ll love the freedom you find by staying on top of your bills. No longer will you feel on edge every month wondering if things will be paid on time. Start by using our tips to reduce financial stress when you decide to make a big budget change. Next, you’ll want to print out our budget planner and bill reminder to get started on the little details of the month to month budgeting.

Get honest about your income and expenses

Our budget planner and bill reminder aren’t just about writing numbers down and crossing them off each month. It is designed to help you make changes in your financial situation. That means you have to get honest about your income and expenses. No fudging the numbers to make yourself feel better.

Put down all sources of regular income. The side hustles that do not bring in consistent income can still be added, but in a separate column so you can easily remove them if needed. Next, you’ll want to go through your expenses and really look at everything you put money out each month. This includes subscriptions, coffee on the way to the park, and eating out when you don’t feel like cooking.

List the mandatory expenses first

Mandatory budget expenses should be listed first and foremost. These things include housing, food, healthcare, insurances, and utilities. For some, that may include cable or internet, while others will consider that a luxury item. This list will be pretty basic but may have room for flexibility if your family works from home. The Internet is not an option for most who work at home or homeschool, so we leave it on the mandatory utilities. Also, some may not have natural gas, but it is still listed as a utility as it is a common need.

Create a plan to pay down outstanding debt

As you use our budget planner and bill reminder, you’ll want to figure out your plan of action. Perhaps you are just wanting to get more organized and don’t have much debt to consider? If that is the case it is all about writing things out and keeping them in an orderly fashion. Being in debt is likely the reason you are here looking for help. When that is the case, you’ll want to look at your debts and evaluate how best to pay them down.

- Pay off smaller balances first to devote those monthly payments to other debt

- Evaluate the highest interest rates and pay off those first when possible

- Remove some expenses to create a more flexible income to pay toward debts

If you have a need, our tips for how to pay off credit card debt will be very helpful in this area of budgeting. Knowing the best methods to begin your debt consolidation process is a must.

Schedule bills when possible

One of the biggest tips we have is to pay your bills on time. Avoiding late fees can really help lower those unnecessary expenses. We even have some ways to always pay bills on time that may be helpful. By scheduling your bills to come out of your bank account on a certain date, you are less likely to forget or have a late payment. However, you do want to practice caution to ensure the funds will be available. This can be more difficult for those who get paid on a weekly basis.

Prioritize a savings fund

One of the most important things you can do for your financial health is to prioritize a savings account or fund. Those rainy days happen all too frequently. If you don’t know where to begin, check out our painless ways to create an emergency fund. This is a must in every budget and will be a lifesaver for you in the future.

Budget Planner and Bill Reminder Printable

Make sure to save this and print a few copies to use month to month. Using the free budget planner is something you will sit down with once per month, but the bill reminder should hang on your desk, be in the front of your household binder, or even on your refrigerator so it is always in view. You can even print and laminate them both so they are easy to use over and over again.

Printable Monthly Budget Planner

This free budget planner worksheet can be printed out in advance so you can start planning your spending and saving for the month. You don’t have to fill in every category and line, only the ones that are needed for your monthly financial planning. Click on the image above or click here to print out the budget planner worksheet.

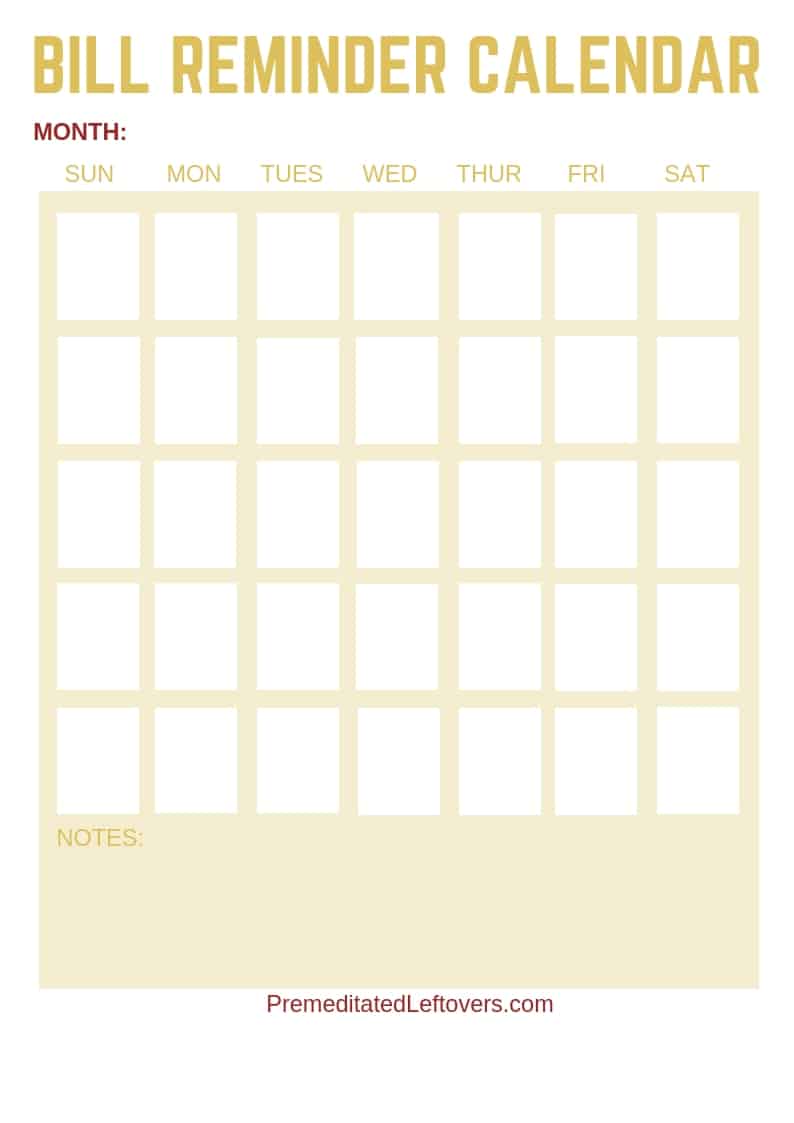

Printable Bill Reminder

Some bills are due the same day each month, but some change slightly each month. This free bill reminder will help keep you on track, so you don’t rack up late fees because of missed payments. It will also reduce your stress because you don’t have to keep track of all of the dates in your mind. A simple glance at your bill reminder worksheet each day will ensure you don’t miss a payment. You can also add them to the calendar on your phone if you want a backup reminder to pay your bills on time. Click on the image above or click here to print out your bill reminder worksheet.

More Budget Tips:

What to Buy When: A Guide to Monthly Sales

Bad Spending Habits You Should Break

Leave a Reply